Sadly, in times of crisis, some people use it as an opportunity to make money. COVID-19 is not an exception to that rule, and the FBI is already seeing a rise of Coronavirus fraud schemes. The FBI is warning Americans to be especially careful during this pandemic hitting our country. Always check your sources when receiving an unusual email. Do not click any links that appear suspicious.

Insurance Fraud

As business owners and employees are starting to learn what is covered under insurance and what is not covered, panic is setting in. Couple the fact that many people are out of work for an infinite amount of time, desperation can set in. People begin to do things for money that they never would have under normal conditions. We found this to be true in the beginning of the Great Recession.

According to to the FBI, “The total cost of insurance fraud (non-health insurance) is estimated to be more than $40 billion per year. That means Insurance Fraud costs the average U.S. family between $400 and $700 per year in the form of increased premiums.” This is something that affects all of us one way or another.

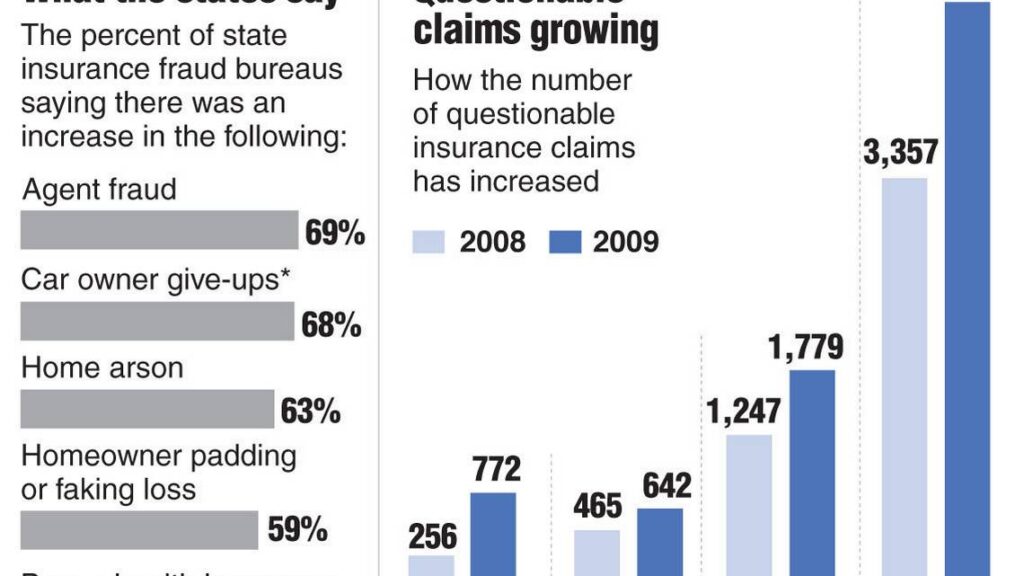

If past behaviors are an indicator, we know that we are most likely going to see a surge in insurance fraud. SIU Investigators are going to be overworked in the months ahead. A surge in slip and fall cases for example will occur. The claims are bound to pile up.

Online & Social Media Research

As a company who specializes in online research for fraud assessments, I can not emphasize enough how important it is to conduct your research as soon as possible. What is here today may be gone tomorrow . People will begin to clean up their social media posts.

If you think that Google and Facebook are all you need to check, you could run the risk of losing your client or employer a lot of money. When steaks are as high as this, a deep web search will serve you best. That is because people love to share online. They may leave crumbs that lead you to the exact place you need to be.

In conclusion, it is an excellent time to get in front of your insurance clients to let them know you are there and ready to go if and when we start seeing fraud increase over the next months.