When we think of fraud due to the COVID-19 pandemic, we think of individual people committing fraud. After all we are only too familiar with workman’s comp insurance scams & most recently, employee fraud. We have discussed in a previous blog post how one Fortune 500 company had a loss of over $100,000.00 after an employee falsely said they were tested positive for COVID-19.

The story now continues with business fraud. Small businesses across the country have been nearly put out of business due COVID-19. Many have been able to stay afloat from government PPP funding. However, some are sadly starting to take matters into their own hands.

What the Experts Predict

Data analytics provider Verisk has alerted folks that COVID has created opportunities to commit medical billing fraud and abuse. In April, the company said its data reported a 14% increase in claims linked to suspicious billing practices.

Verisk said its Insurance Service Office MedSentry team has identified several COVID-19 medical billing schemes. Among them:

- Unlisted lab tests. There was no specific ICD-10 code for COVID-19 until April 1. Prior to then any COVID-19 tests were likely coded as “unlisted laboratory tests.” Claims for a patient who has received both an unlisted laboratory test and a COVID-19 test may be cause for scrutiny.

- Hands-on therapy charges. Many providers eliminated in-office visits and began to offer telehealth sessions. Verisk said bills for hands-on therapies such as chiropractors, physical therapists, and massage therapists should be examined.

- Unnecessary durable medical equipment. Insurers should be wary of misleading claims for gloves, face masks, thermometers, and similar items, especially for patients who have not been tested for COVID-19 or have tested negative, Verisk said.

Social Media Monitoring

Work is being done to create a software that allows the user to find unapparent connections between all people in a claim to uncover potential scams. While it has a way to go in development, if created, it would be an excellent resource to help investigators identify potential scams and link the culprits.

Google Search – Trending

Google searches can be very revealing and a good indicator of what people are thinking of doing. The question, “How to Burn a Car” has increased 125% since January of this year.

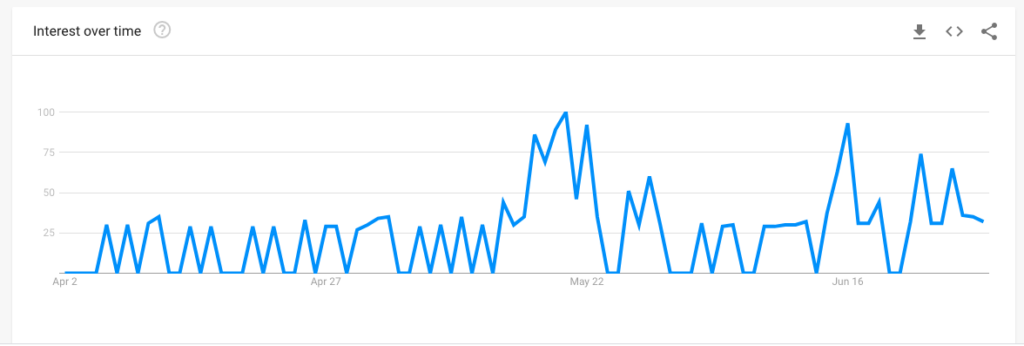

Not surprising, Google is showing some strong trending in Employment Fraud. The graph below shows Google trends over the last 90 days.

We will continue to report our findings during the pandemic.