Back in April we wrote about fraud predictions during the COVID 19 pandemic. Back then most of what was out there was PPE (Personal Protective Equipment) fraud. We saw a lot of fakes and it even began to show up in COVID testing. Much of this was controlled by the FDA who provided consumers with updated information on their website on a regular basis.

Once the government released stimulus checks, the scams began. Scammers were contacting people through email, telling them that their check, as part of the stimulus package responding to COVID-19, is already waiting for them and that all they need to do is to provide personal information. This included bank account numbers and Social Security Numbers, which are the key pieces of information needed to perpetrate identity theft.

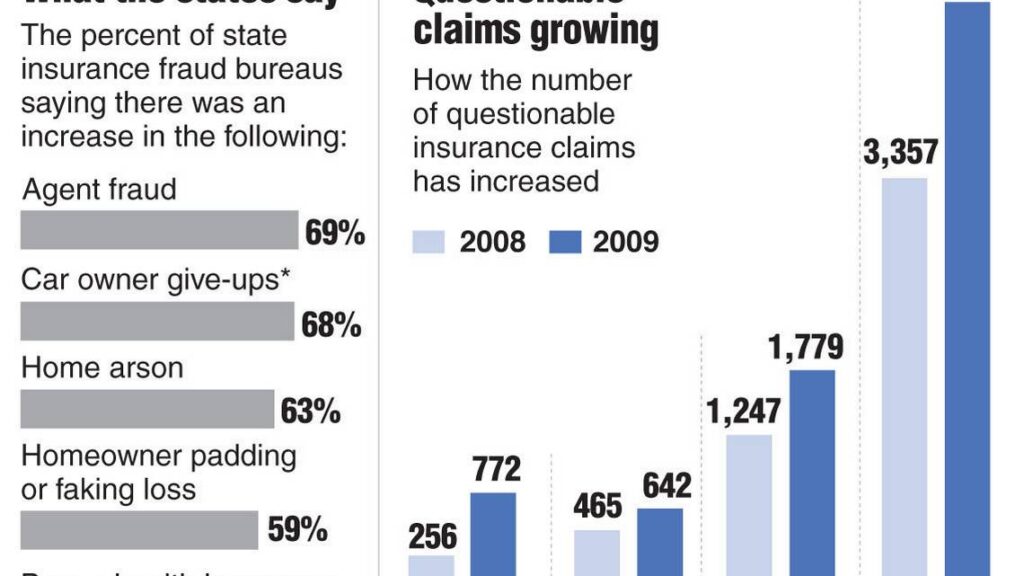

Bruce Dorris, J.D, CFE, CPA, President and CEO of the Association of Certified Fraud Examiners, explains that in the current conditions, we can expect to see a number of long-lasting implications. One important one being an explosion of fraud in the coming years — and organizations need to brace themselves.

Corporate Employee Misconduct

Some of our corporate associates have expressed concern with what lies ahead as they navigate the uncertain waters of the Pandemic. One company in particular needed to shut down an entire plant because an employee tested positive for COVID. The employee presented the company with a falsified COVID 19 medical claim. He went as far to provide an excuse letter from a medical facility appearing to corroborate the test results. In concern for its employees and customers, the company closed its facility for cleaning and paid its employees during the shutdown. This caused a loss in excess of $100,000 to the corporation and the unnecessary quarantine of several of the defendant’s coworkers. He is now released on $15,000.00 bail awaiting trial.

FBI Recommendations

The FBI has recommended that companies be particularly alert during the pandemic about possible fraudulent work excuse letters, as they are finding more people attempting to exploit the situation for personal or financial gain. Submission of a medical claim proven to be false could lead to criminal penalties, including fines or imprisonment by U.S. federal and other authorities.

What This Will Mean for the Private Investigator

Investigation around employee misconduct is an area that could prove to be quite lucrative for investigators. ABC News in Phoenix, AZ did a story on how local investigators are getting calls from corporations to check up on employees who should be working from home. This is not an isolated incident.

I believe we will see more and more fraud cases such as this over the next year if not longer.