When you think of reputation management, what industry comes to mind? Perhaps you would think of a PR or Communication company. We have all seen commercials on TV around companies that can help you improve your image. They promise to get rid of those bad reviews, gather up good ones, and make you look like you are the best thing out there. But are they missing something? I believe they are. Here’s why.

Chief Reputation Officer

What many companies don’t think about is that reputation management is something that needs to happen proactively, not reactively. A recent Forbes article titled “Five Reasons Your Company Needs A Chief Reputation Officer” explained it best.

“Most companies, including your competitors, are usually only thinking deeply about reputation management after a crisis has hit. They react and try desperately to repair the damage. This is a huge missed opportunity because the damage done was often completely avoidable. Just like no sports team wins a game playing only defense, your company needs to play strong defense and come out with a strong offense.”

Forbes

Where the Private Investigator Comes In

When I speak to Private Investigators, I am amazed that many have not thought about this area as a vital way to grow their business. In my opinion, they should be considered to be part of any good reputation management program or team. In our digital world, they will be able to determine exactly what needs to be monitored and how. After all, they do this type of investigating all the time.

Family law, infidelity cases and divorce depositions have been mainstream avenues for revenue for decades. Some of the PI’s love them, and some avoid them like the plaque. Those that avoid them do so because of the amount of work vs. the amount of compensation.

Promote your business as a firm that covers Corporate Reputation Management services. By doing so, you are in some ways, investigating for a company in some of the same ways you would be investigating for a cheating spouse. Only better, because the work is proactive VS. reactive. If you catch an issue that a corporation has online before it goes viral, you have saved the day.

Back in June, we wrote about Employee fraud and COVID19. In that post, we cited a Fortune 500 company’s loss of over $100,000.00 because of a plant shut down due to a dishonest employee. It happens more than we know.

Proactive Steps to Take

As a service offering, it is smart to offer a corporate client a deep web scan on their business. What does their online profile reveal? Some things to consider:

- Reviews are obvious, but many people think of them as Yelp, Google, and Trip Advisor. They are the biggies, but there is much more out there.

2. Location based Monitoring: Does the company have more than one location globally? By creating a virtual fence around physical locations, an added security level is created for any violent social media mentions in the area. Additionally, automatically pull in any negative keywords for reputation management.

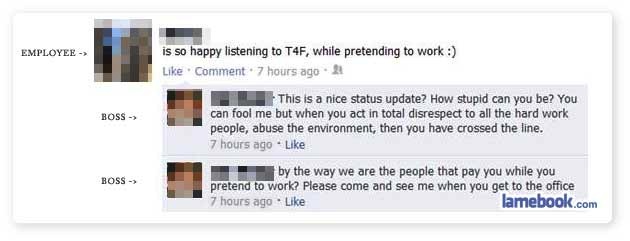

3. Employee Revenge. As more and more employees are laid off because of our current pandemic situation, some are understanding and some are not. It is human nature. Just today, I read a post in LinkedIn about a disgruntled employee telling everyone how she was let go from a major company. She went on to say that she mistakenly placed all of “who she was” around this position for the past 8 years and how this was a major life mistake. Her post gained a lot of views and encouraging comments, as it should. However, think about the company’s name there. Most people are left with the impression that the company did something wrong to her. We don’t know the full story, but it can still leave a lasting impression. Glassdoor is a website where current and former employees anonymously review companies. I will bet many don’t even know about that one site alone.

See the possibilities yet? Do you think in today’s online world, this could be something your firm is capable of doing? Email me if you would like to kick around the idea for your firm.